unified estate and gift tax credit 2020

The previous limit for 2020 was 1158 million. The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise subject to either the gift tax or the estate tax and a tax credit ie it reduces the amount of tax owed.

Qualified Domestic Trusts And Portability Palisades Hudson Financial Group

The credit allows up to a 2500 tax credit annually for qualified tuition expenses school supplies or other.

. In other words use it or lose it. Gifts and estate transfers that exceed 1206 million are subject to tax. The lifetime gift tax exclusion was expanded under the Tax Cuts and Jobs Act and with an inflation adjustment in 2020.

For 2021 the estate and gift tax exemption stands at 117 million per person. When must it be filed. The unified tax credit is designed to decrease the tax bill of the individual or estate.

The Internal Revenue Service recently announced the inflation-adjusted estate and gift tax exclusion amount for 2020. Thus in 2026 the BEA is due to revert to its pre-2018 level of 5 million as adjusted for inflation. The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death.

Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a. The estate tax is a tax on your right to transfer property at your death. When an estate is below the unified gift and estate tax credit limit there will be no estate tax due at the time of death.

1158 million for 2020. The recipient typically owes no taxes and doesnt have. This is called the unified credit.

The Internal Revenue Service announced today the official estate and gift tax limits for 2020. As of 2021 married couples can exempt 234 million In 2022 couples can exempt 2412 million. Find some of the more common questions dealing with basic estate tax issues.

In addition to the unified tax credit individuals can give up to 15000 a year to a recipient or recipients 15000 per gift to as many recipients regardless of how many people you gift and not have to pay a gift tax. Estate Planning 2017 2018 2019 2020 Annual Gift Tax Exclusion 14000 15000 15000 15000 Annual Gift Tax Exclusion to a Noncitizen Spouse 149000 152000 155000 157000 Applicable Exclusion Amount. Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million and for 2020 the BEA is 1158 million.

As the amount of the unified credit is scheduled to be halved in 2026 clients thinking about making gifts now to use the increased unified credit amount before it is reduced wondered whether there would be a clawback of any unified credit used now that wasnt available when they die. Currently you can give any number of people up to 16000 each in a single year without incurring a taxable gift 32000 for spouses splitting giftsup from 15000 for 2021. The amount of the Unified Credit is currently higher than it has ever been while an estate tax is.

In 2020 after adjustment for inflation it was raised to 1158 million for individuals and 2316 million for a married couple. Under the tax reform law the increase is only temporary. In 1976 Congress unified the gift and estate tax regimes thereby limiting the givers ability to circumvent the estate tax by giving during his or her lifetime.

For gifts made and estates of decedents dying in 2020 the exclusion amount will be 11580000 per person up from 11400000 in 2019. Your gifts can total 30000 for the year if you want to give two people each the annual exclusion amount. The IRS announced new estate and gift tax limits for 2021 during the fall of 2020.

It consists of an accounting of everything you own or have certain interests in at the date of death. The lifetime gift tax exclusion in 2020 is 1158 million meaning the federal tax law applies the estate tax to any. Instead all of those funds pass directly to the specified recipients.

Gift and Estate Tax Exemptions The Unified Credit. What Is The Unified Tax Credit How Does It Change Federal Gift And Estate Taxes. Estate and Gift Taxes.

It can be used by taxpayers before or after death integrates both the gift and estate taxes into one tax system is adjusted for inflation and has no income limit. You can give up to this amount in money or property to any individual per year without incurring a gift tax. Take 345800 and add in 40 of the 1058 million excess and you get a total unified credit of 4577800.

Learn about the COVID-19 relief provisions for Estate Gift. Gift Tax 5490000 11180000 11400000 11580000 Estate Tax 5490000 11180000 11400000 11580000 Applicable Credit Amount. It can be used by taxpayers before or after death integrates both the gift and estate taxes into one tax system is adjusted for inflation and has no income limit.

It just keeps getting better for wealthy individuals. Taxpayers that expect to have a taxable estate may. The annual gift tax exclusion is 16000 for tax year 2022 up from 15000 from 2018 through 2021.

The unified credit is per person but a married couple can combine their exemptions. For 2022 the exemption increases to 1206 for individuals and 2412 for married couples filing jointly up from 117 million and 234 million respectively for 2021. For 2021 that lifetime exemption amount is 117 million.

For estates over that amount however such gifts might result in an increase in estate taxes. This credit is significant as amounts above this level will be taxed at rates starting at 18 and gradually increasing to 40 as of 2020 based on the size of the estate. A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure.

The unified tax credit is designed to decrease the tax bill of the individual or estate. The estate and gift tax exemption is 1158 million per. The American Opportunity Tax Credit helps offset costs for post-secondary education.

Then there is the exemption for gifts and estate taxes. The unified tax credit has changed over the years sometimes materially with each tax bill passed. Thats up 72000 from what it was for those who passed away in 2019.

Irs Announces Higher Estate And Gift Tax Limits For 2020

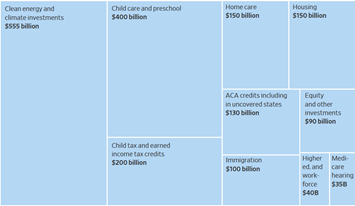

Build Back Better Act Updates To Biden S Plans Avidian Wealth Solutions

How To Pay Those Upcoming College Bills

Year End Tax Planning Don T Forget To Factor 2020 Cost Of Living Adjustments Weaver Assurance Tax Advisory Firm

How Much Of A Gift Can You Give To Someone To Buy A House

The Basics Of Us Estate And Uk Inheritance Tax

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

2016 Federal Estate Tax Exemption Amount Wills Trusts And Estates

2021 Year End Review Marcum Llp Accountants And Advisors

F 1 A 1 Ff12021a3 Jianzhiedutech Htm Registration Statement As

2021 Year End Review Marcum Llp Accountants And Advisors

The Tax Implications Of A Canadian Owning Property In The United States Insights Winnipeg Law Firm Fillmore Riley Lawyers

U S Estate Tax And Cross Border Benefits For Canadians Kerkering Barberio Co Certified Public Accountants Sarasota Fl